In Credit Weekly Snapshot – July 2023

Our fixed income team provide their weekly snapshot of market events.

Pulling the plug on privatised water?

The resignation of Thames Water’s chief executive triggered speculation about nationalisation of the company. We explain why we don’t think that’s likely.

European Utilities: as good as it gets…

Explaining why we’ve improved the European Utilities sector fundamental score from Neutral to Positive.

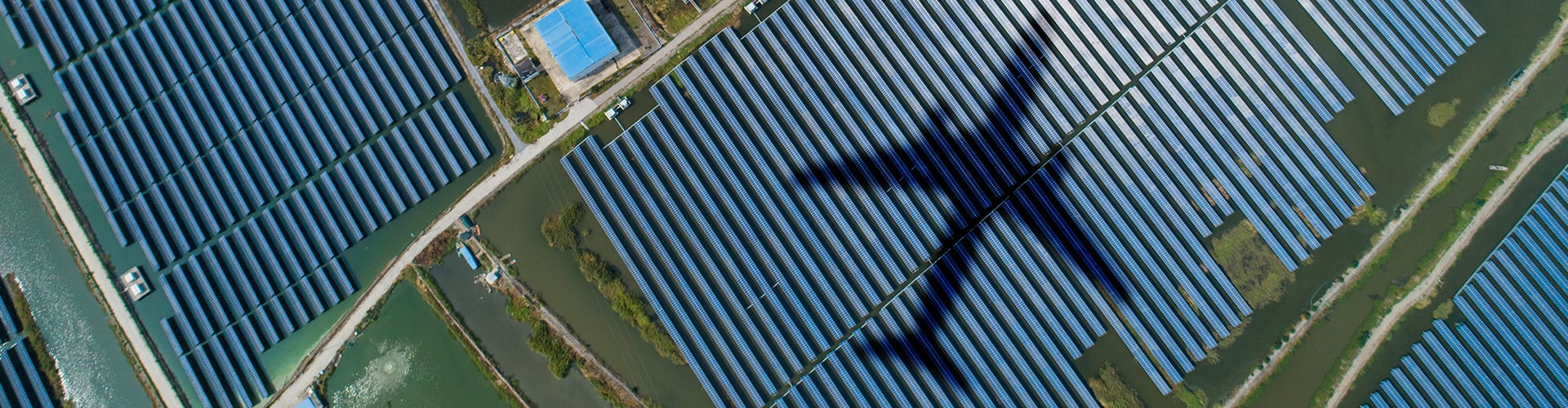

A unique lens on banks and net zero

How are financial institutions embracing the energy transition and managing climate change risks, and what are the opportunities presented by the decarbonisation process?

Through the windshield: rate hikes and borrowing costs for investment grade companies

The impact of rate hikes and borrowing costs on investment grade companies

In Credit Weekly Snapshot – June 2023

Our fixed income team provide their weekly snapshot of market events.

Andrew Dewar

Andrew Dewar is a portfolio manager in the Investment Grade Credit team at Columbia Threadneedle Investments.

Residential and datacentres – European investment grade credit

Finding the right locations in European real estate credit. Any why residential and datacentres look attractive.

In Credit Weekly Snapshot – May 2023

Our fixed income team provide their weekly snapshot of market events.

Under pressure – European real estate credit

Europe’s real estate sector has been under pressure since mid-2021. What’s behind its struggles and where can we find attractive credit opportunities?