Air pollution as a global imperative

The World Health Organisation (WHO) estimates that air pollution contributes to seven million deaths per year, largely concentrated in South-east Asia and the Western Pacific.1 While the death toll resulting from this is higher in these countries, it is by no means an isolated problem; indeed, on some measures of pollution cities such as London and Paris are highly comparable to Delhi and Beijing (for instance when assessing 2016 nitrogen dioxide levels, all four breached EU limits by 11%-25%).2

Air pollution is deleterious to human and ecosystem health. Impacts vary but can include problems for the heart (driven by eg carbon monoxide), lungs (eg, nitrogen and sulphur oxides) or both (eg, particulates). Environmental consequences, meanwhile, include reduction of photosynthesis (eg, ozone); damage to foliage and growth (eg, sulphur dioxide), depletion of water and soil quality (eg, particulates).3

Causes are similarly varied, some natural and many man-made. The former includes volcanic activities and dust, the latter the combustion of non-renewable fuels, heavy industry and agricultural practices.4

Figure 1: Where does air pollution come from?

Source: World Health Organization.

Key to meeting the Sustainable Development Goals

Given the magnitude of the issue, air pollution is specifically mentioned in two Sustainable Development Goal (SDG) targets, under SDG 3 (good health and wellbeing) and SDG 11 (sustainable cities and communities). Attached to the former is a specific indicator tracking progress directly on “Mortality rate attributed to household and ambient air pollution”.5

The wider impacts of air pollution mean the issue also has implications for a number of other SDGs. These include: SDG 7 (affordable and clean energy) and SDG 13 (climate action), given the interplay between climate, energy and pollution; SDG 6 (clean water and sanitation) and SDG 14 (life below water), given the impact on water quality and marine life; and SDG 15 (life on land) and SDG 12 (responsible production and consumption), given wider environmental causes and impacts.

So our ability to adapt social, economic and financial activities to address the issue is not only key to realising those SDGs with an explicit focus on air pollution – but has implications for the achievement of almost half of all global goals.

Figure 2: SDGs with sub-goals relating to air pollution

Source: United Nations.

Investment opportunity

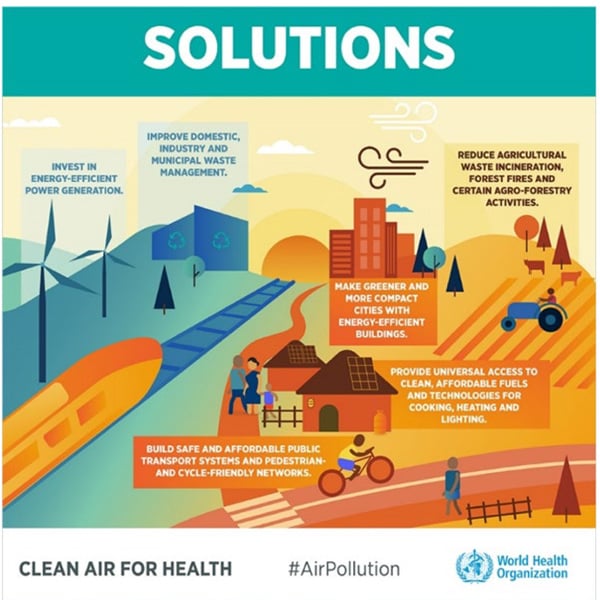

Importantly, this is not just a global problem but an area of increasing investment opportunity. There are a number of solutions which investors can support, and from which we and our clients can benefit. One of the most salient is investment in “energy-efficient power generation” which the WHO has recommended in its overview of potential solutions.6

Figure 3: What can be done about it?

Source: World Health Organization.

From our perspective, we have identified three areas of growing focus which can act as a catalyst for investment opportunity, reflecting strong interest across governments, regulators, society and corporates – these are China, cities and states, and oceans. We also draw out some practical examples.

China

Air pollution is a driving force in the new vision of China as a green economy. This is backed by government support, cost reduction of clean energy and technology and strong social pressure. For instance, China now has a distinct Air Pollution Plan 2018-2020,7 clarified “serious consequences” of violating environmental protection laws, and has a target of generating 31% of power from non-fossil fuel sources by 2020.

In this context investment opportunities are ripe for companies with environmental technology which can aid China’s plans. For instance, the US International Trade Administration sees this area as a $66 billion opportunity, which has enjoyed 13% growth8 for more than a decade and with continued strong prospects.

One company recognising such opportunities is Thermo Fisher Scientific, one of the largest players in the air emissions monitoring market worldwide (covering both particulates and ambient gas emissions). China accounts for 10% of sales and has been its “greatest success story in emerging markets” – and the company is working closely with the Chinese government on its plans relating to the environment, health and food.9

Cities and states

Although China is a particularly strong driving force, action is being taken by a range of other governments too, and perhaps more interestingly by a range of more local players.

Major cities and states around the world are committing to enhance their environmental credentials. A number have plans to phase out conventional auto transport, and more than 9,000 cities and regions have made climate-related commitments.10 Their action counteracts the ability of central governments to effectively “roll back” on these issues (such as the US’s withdrawal of support for the Paris Accord) and economic drivers are also keeping up momentum – for instance in some states, solar is already the cheapest form of energy.

Related investment opportunities include EV manufacturers and enablers, as well as those reducing emissions from conventional engines (for instance through catalysts converting pollutants to less harmful by products). Three companies – Johnson Matthey, BASF and Umicore – stand out as active players in both markets, thus able to benefit from efforts to reduce pollution from current vehicles, and from the accelerating transition to EVs.

Equally, those in the renewable energy value chain, including suppliers, developers and utilities with strong business propositions are fruitful areas for exploration. One such firm is Tekmar, a recently listed company based in the UK, which provides sub-sea cable connectors for Offshore wind farms. With 70% market share in Europe, the company is increasingly exploring international opportunities.

Oceans

Finally, a growing area of focus is found in the regulation of fuel used in ocean transportation, paralleling increasing consumer interest in the impact of their activities on marine environments. The shipping sector accounts for about 10% of the world’s oil demand in the transportation sector, and current Sulphur-heavy fuel consumed by the vessels contains 3,500x higher sulphur than standard automotive diesel.11

However, this is ripe for change. The International Maritime Organisation is significantly reducing acceptable sulphur content from 3.5% to 0.5% by 2020. China plans an earlier phase-in. Only by installing “scrubbers” (devices removing sulphur dioxide from exhausts) can non-compliant high sulphur heavy fuel continue to be burned. Upon implementation of these regulations, the price between high and low sulphur fuel should widen, making scrubber installation an attractive solution for many. Hence beneficiaries can include public companies offering good scrubber technology.

Participation in the solutions

Overall, although a failure to address air pollution poses a tangible risk to human and ecosystem health, and to the achievement of the SDGs, the examples and opportunities above offer evidence of a way forward. In fact, taking steps to address the problem of air pollution offers a prime example of how social, political and economic pressures can combine to catalyse not only tangible solutions for a more sustainable future, but also financially attractive opportunities from participating in this progress.

The mention of any specific companies or bonds should not be taken as a recommendation to deal.