Chris Wagstaff considers how asset owners might best approach climate change risk management by adopting a number of non-mutually exclusive mitigating actions to address transition and physical risks.

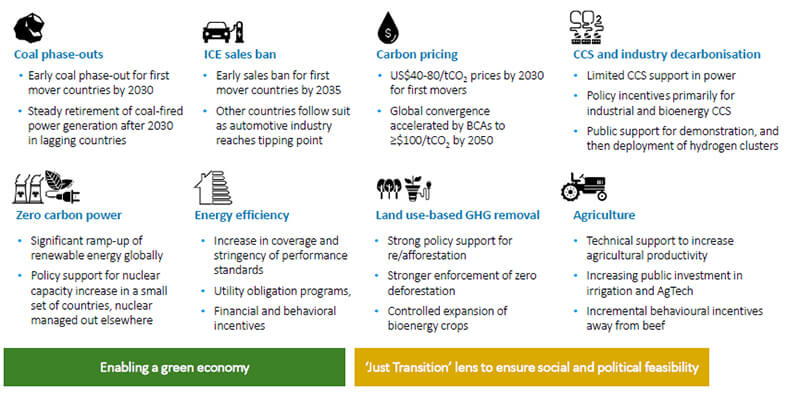

In cautioning against a disorderly and disruptive transition arising from a likely forceful near term policy response to climate change, the UN Principles for Responsible Investment (PRI) has, through its Inevitable Policy Response (IPR) project,1 sought to prepare investors for these climate transition risks. By forecasting a central scenario of accelerated and disruptive policy actions, occurring between 2023 and 2025, the PRI identifies eight critical policy levers, of climate-related policy and technological developments that are likely to emerge between now and 2050, to ultimately secure an accelerated and just transition to a low carbon emissions world. These are illustrated in Figure 1.

Figure 1: The PRI’s The Inevitable Policy Response forecast policies could secure an accelerated and just transition to a low carbon emissions world

Carbon capture and storage (ccs) is the process of capturing waste carbon dioxide (CO2) usually from large point sources, such as a cement factory or biomass power plant, transporting it to a storage site and depositing it where it will not enter the atmosphere.

Source: PRI, The Inevitable Policy Response, December 2019.

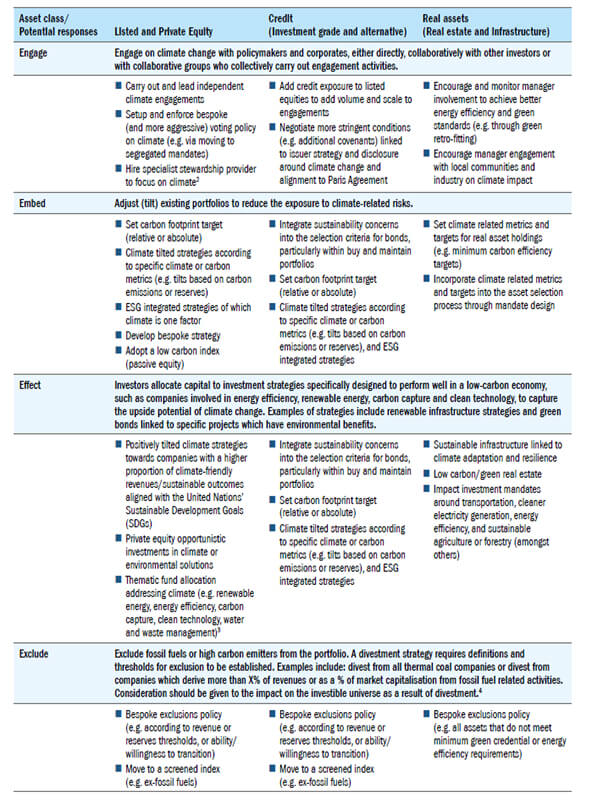

Against this backdrop, asset managers and asset owners in analysing the potential transition and physical risks across the various asset classes held in an institutional portfolio, can adopt a number of non-mutually exclusive mitigating actions to address them, by choosing to engage, embed, effect and/or exclude, as appropriate.

Of course, who exerts this influence is principally determined by whether a mandate is segregated or pooled. Within a segregated mandate the asset owner is in the driving seat, whereas in a pooled mandate, it is the asset manager. That said, the asset owner can, of course, make the manager aware of their climate policies and ultimately decide whether to hire or deselect the manager.

In considering these potential mitigating actions, Figure 2, below, separates the asset classes held within most institutional investor portfolios into three broad categories: listed and private equity; investment grade and alternative credit; and real assets, comprising real estate and infrastructure. It then analyses the potential responses (engage, embed, effect and/or exclude) to the climate change risk posed by each asset class.

Figure 2: Asset class response matrix to transition and physical risks

Note: Caution should be exercised given that some of the approaches outlined above may impact the risk and return characteristics of a portfolio. In addition, while some may result in more appealing exposure disclosures, they may not make any contribution to climate change mitigation.

Source: WTW 2019 (modified extract).

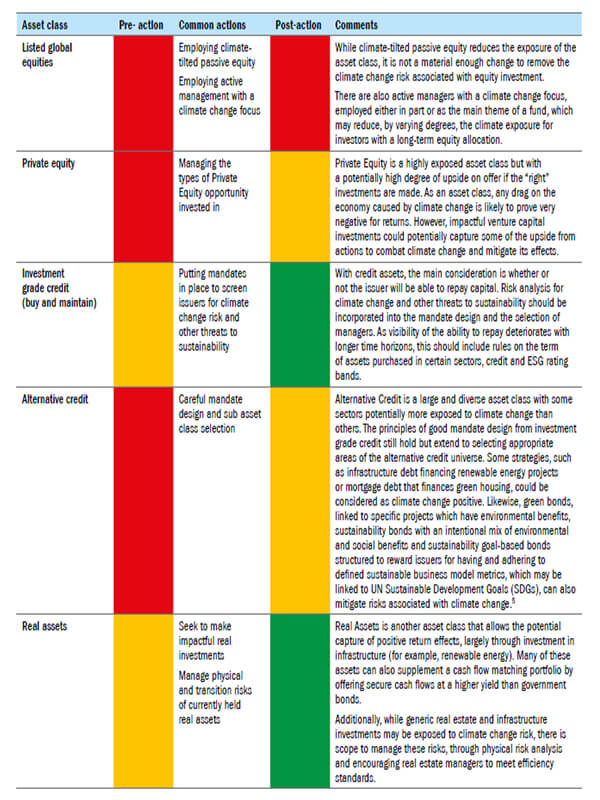

Summary of actions available to asset managers and asset owners

Figure 3, comprising Asset Class RAG scoring, quantifies the climate change risk exposure of some of the main asset classes both before any asset owner actions are taken and after some of the more common asset owner actions are taken. It assesses the practicalities of these actions and how effective they may be. Accepting the subjective nature of this analysis, those asset classes classified as red are at particular risk of negative outcomes arising from climate change while those classified as green are either unexposed to – or even potentially positioned to take advantage of – efforts to combat climate change.

Figure 3: Asset Class pre- and post-actions RAG scoring

Source: WTW 2019 (modified extract).

Concluding comments

Despite the key obstacles to assessing portfolio exposures to carbon and GHG emissions, asset owners have a considerable climate risk mitigation armoury at their disposal that can be deployed across both mainstream and more illiquid assets to great effect. In particular, those actions that can be applied to investment grade credit, infrastructure debt financing, renewable energy projects, green bonds linked to specific projects with environmental benefits, sustainability bonds, sustainable infrastructure linked to climate adaptation and resilience and low carbon real estate, are well positioned to guard against the transition and physical risks of climate change and may also potentially benefit from positive outcomes.

Additionally, many asset managers and asset owners are not only adopting a number of the above mitigating actions to address the transition and physical risks of climate change but are also unilaterally taking steps to align with and, indeed, move the low carbon transition agenda forward, while voluntarily signing up to an increasing number of collaborative initiatives with their peers to achieve the same objective. Given how well asset managers and asset owners are positioned to be the catalyst for major transformative change, more of the same is needed for the bar to continue to be raised.