We have seen something of a recovery in global markets since the pandemic struck, but this is very much the first pulse1. This was always going to be significant, given the magnitude and speed of action taken by central banks and governments, led by the Federal Reserve. It has been shock and awe, with all records being broken, both fiscal and monetary stimulus – the Fed stimulus alone has reached more than $3 trillion, equalled by US government physical stimulus.

We must now ask ourselves: is there a danger of emergency medicine becoming a lifestyle drug, particularly in the US? The S&P gains have largely been led by the five big tech megaships, which have risen 35% while the other 495 stocks declined by 5%. It has led to Apple being bigger than the whole of the FTSE 100 and larger than the bottom third of the S&P; while those biggest five US stocks are now bigger than the entire Japanese TOPIX index.

Uk equities in a 'doom-loop'

But what does all this mean for UK equities? It helps to put the UK market in context. The S&P, led by the mega tech stocks, has clearly rocketed, exhibiting the very pronounced growth versus value trend we have seen in recent years. The surge of mega tech indicates that investors have become fixated on “visions” and growth in pursuit of future proofing their investments. But the US could be prone to tidal waves of profit taking – some of which we have already seen with nearly $7 billion of director selling in August alone.

This pursuit of future-proofing investments has led to bubble characteristics in the tech sector, which could be kick-started by anything from exogenous-led investor jitters to regulation or antitrust legislation targeted at the seemingly all-powerful tech entities.

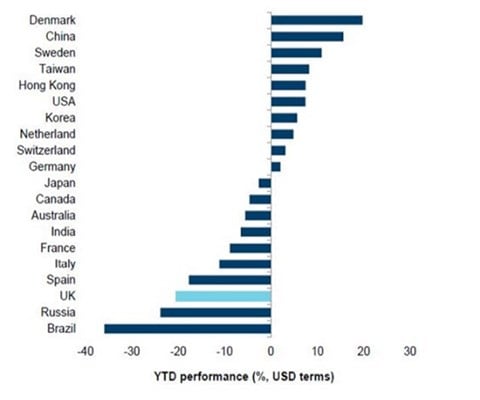

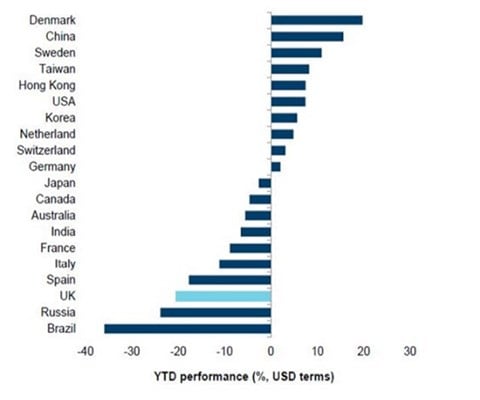

Contrast that with the UK which, as an asset class, has been beleaguered for quite some time. By January the UK had underperformed for four years, and if markets were to grind higher from there we believed UK equities would be more resilient given the stark valuation gap. This was wrong. But why? Clearly the unique nature of the pandemic is a factor, but our country peers have also had to deal with Covid-19 and, as Figure 1 shows, we are propping up the table of performance year-to-date (if you exclude Brazil and Russia). We are in a kind of ‘doom-loop’.

Source: Bloomberg/Morgan Stanley, 27 August 2020

This is clear when you look at recovery rates from the February/March losses. The US has more than recovered those loses with a 120% recovery, emerging markets are showing a 98% recovery, Europe ex-UK is at 72% of losses, but the UK is at just 43% of losses. This is somewhat driven by hedge funds, which have to offset the big bets they have taken on US tech by short selling something – and that happens to be UK equities.

Valuations: mind the gap!

On many metrics, UK equities have seriously underperformed for decades. PE yields, price-tobook and performance have returned to levels lower than they have been since the 1970s against the MSCI World index (Figure 2). We are very cheap, even when you strip out energy and banks, and this reflects 20 years of divestment out of the UK asset class, led by pension funds.

Source: Morgan Stanley, 31 July 2020

We expect more bids to follow, certainly from private equity which has plenty of firepower in the UK as it can exploit that value arbitrage. Will Brexit delay these buying intentions? That is unlikely given the world has priced in a hard Brexit and a no-deal scenario. The debate should be focused on whether share prices are at the point private equity will table deals, and my sense is that the first bids will have to come in at around 50% premiums, rather than the typical 30%.

The importance of experience

The future seems bright not just because of our conviction in the UK market, but because of our experience and the collaborative nature of how we go about our work. We currently have members in the team who have been through down-cycles before, and those that are going through their first down-cycle will remember it well as it is a very important learning ground.

This particular downturn really is different, and there has been great debate about stocks, sectors and wider economies. But one thing that has not changed is the massive engagement we have had with companies; in fact, we have had greater engagement than we would have normally had in pre-Covid days.

Looking to the future

We would argue that UK equities are poised to recover strongly – and sooner rather than later. As a value asset class it currently offers some of the best opportunities in distressed shares for a decade.

It clearly has many stocks disrupted by Brexit, as well as those sectors impacted by Covid, such as leisure, travel and retail. But going forward we do not want to disregard these troubled areas, we want that optionality in our portfolios alongside the resilience that served us well and kept us out of trouble since the pandemic hit – sectors such as pharmaceuticals and food retail.

We have avoided banks for 10 years or so, though we always keep a close eye on them. Bank debt provisions are going to flare up even further post-furlough, so that is an obvious headwind as are potential negative interest rates. Banks led the charge out of the early-1990s recession, though that wasn’t until 1992, so the question we must ask with this analogy is whether we are currently in 1989, 1990 or 1991. We had a cyclical recovery rally after Boris Johnson was elected and our strategies outperformed as a result because we had stocks of a similar nature that did well. So when it comes to banks we must pit whether to buy into a stock in that sector against whether to buy more ITV, BT and Marks & Spencer.

We are not trying to surf the wave and outperform every quarter, or every year, and this means that performance across our range of UK equity strategies will be uneven.

My small-cap colleagues on the team are very animated about opportunities, despite challenges such as Brexit and Covid-19 that might lead to questions about the short-term future for smaller companies. The UK’s smaller companies tend to underperform for four or five quarters following a recession2 (and we are in the third quarter now) but they also tend to outperform for two or three years. So we are close to a very interesting point in the cycle for that particular part of the market.

Brutal dividend cuts

Broadening out to the wider UK equity market, on the income front all the focus is on dividends. The dividend cuts we have seen were more brutal than in the last downturn, but we always get a dividend rebasing at the end of each cycle, and we are trying to smooth that through the cycle as we did following the global financial crisis in 2008-09. The expectation is that UK market dividends will be down 40-50%. We are confident that we will be able to mitigate the cut in this distribution and not fall as steeply as the market, and still offer an attractive yield.

Also, we do not want to sell some of the stocks that have had to wipe out their dividends because, again, we like the optionality in the income portfolio, just as we did in 2009. It is the capital growth prize that we want to capture, so it pays for us not to be too obsessive about dividends to the detriment of the total return.

The UK market might be the land that time forgot, but the best time to invest can be when it feels most uncomfortable. As we emerge slowly from the ongoing pandemic crisis, UK equities are poised to deliver on what is the best opportunity for this asset class since the global financial crisis.